FOCUS ON 403(b) PLANS

Helping Not-for-Profits

Not-for-profits are special places, solely focused on their mission. Their employees work there because it’s the lifestyle they have chosen, not to make a lot of money. Their retirement plan is essential to their financial security and, in all likelihood their largest asset.

Managing the 403(b) plan is typically the responsibility of the Chief Financial Officer and because CFOs have so many competing priorities, they often do not have the time or resources to devote to the retirement plan. Pinnacle helps not-for-profit institutions in three areas – fulfilling their fiduciary responsibilities, evaluating the effectiveness of their plan and identifying ways to enhance their plan and help employees.

Pinnacle’s Research Initiative

Pinnacle has undertaken a multi-phased research project – we have analyzed more than 500 plans and our initial focus is on fees and investments. We will share benchmarking data and innovative metrics on how plan participants are using their plan’s investments. We will outline the optimal investment line-up and how plan enhancements can translate into increased employee engagement and better retirement outcomes.

ERISA’s Fiduciary Standard

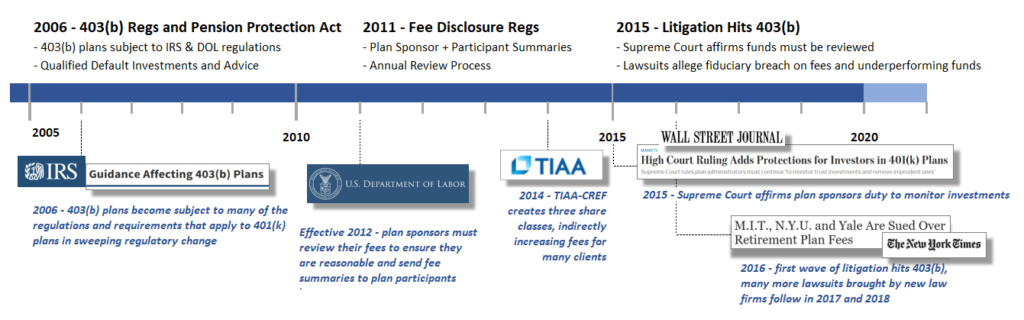

Over the last decade, new regulations have made managing 403(b) plans complex and time consuming. The Fee Disclosure regulations, which require plan sponsors review plan fees, are particularly complicated and time-consuming.

Ultimately, plan fiduciaries and Retirement Committee need to be able to demonstrate

- the plan is managed so it satisfies ERISA’s “prudent expert” standard and

- the fees the plan pays are reasonable compared to the services received

As is true for other fiduciary functions (like reviewing investment performance and making fund changes) the best approach to evaluating fees and services is to follow a prudent process and document how the Retirement Committee made its decisions. Warren Buffet has a great quote to keep in mind, “Fees are what you pay, value is what you get”.

Investment Menu Design and Oversight

In a landmark case, the Supreme Court affirmed plan sponsors have the ongoing duty to monitor a plan’s investments, making sure that the plan is operated solely in the best interest of plan participants. Yet despite a decade of regulatory focus on 403(b) plans, many not-for-profits have yet to update their investment line-up. Even in situations where a plan sponsor has added new investment options, the new funds are often underutilized. Typically, new investments, options which have been recommended by an investment consultant and approved by a Retirement Committee, accumulate only 1% or 2% of plan assets per year due to lack of employee engagement.

Pinnacle’s research will highlight some of the common problems with investment line-ups, for example plans that offer

- only their record-keeper’s funds (100% proprietary line-up)

- too many funds overall and redundant funds within asset classes

- funds that should eliminated due to underperformance or high expenses

Pinnacle’s Proprietary Framework

To wrap up the first of this multi-phased research initiative, we will unveil our framework for gauging a plan sponsor’s progress in enhancing their plan so it maximizes the value of the retirement program to their employees.

Sign Up Here For More Information